Thorough Assessment and Gap Analysis

Our experienced team conducts a comprehensive assessment of your organization's current security controls and processes. We identify gaps and vulnerabilities, providing you with a clear understanding of the areas that require improvement to meet PCI DSS requirements.

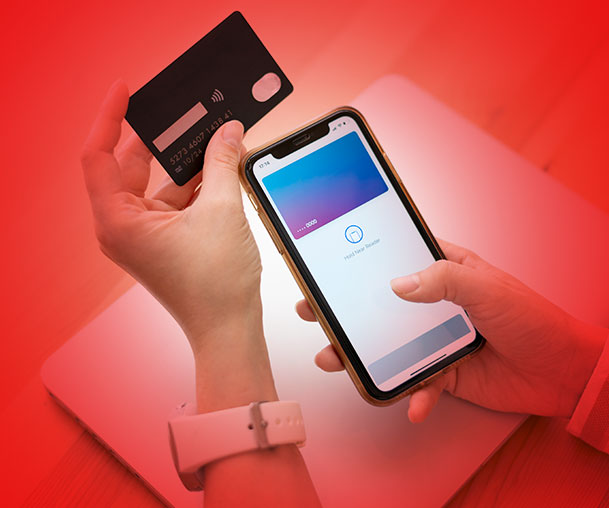

Secure Payment Processing Solutions

We offer guidance on selecting and implementing secure payment processing solutions that adhere to PCI DSS requirements. Our experts help you navigate the complexities of payment processing technologies, ensuring that your systems are configured properly to safeguard cardholder data.

Ongoing Compliance Management

Achieving PCI DSS compliance is just the beginning. We provide ongoing support to ensure your organization maintains compliance over time. This includes regular audits, vulnerability scans, policy reviews, and staff training to stay up-to-date with the evolving security landscape.

Our Approach

Tailored Solutions

We understand that each bank's cybersecurity needs are unique. Our experts work closely with your organization to develop customized solutions that align with your specific requirements, ensuring comprehensive protection against cyber threats.

Expertise and Experience

Our team comprises seasoned cybersecurity professionals with extensive experience in the banking industry and a deep understanding of RBI's cyber security guidelines. Rest assured, you will be partnering with experts who possess the knowledge and skills necessary to fortify your defenses.

Regulatory Compliance Excellence

Achieving and maintaining RBI cyber security compliance is our top priority. Through meticulous regulatory compliance assessments and ongoing monitoring, we ensure that your bank remains fully compliant with the latest guidelines and regulations.

Robust Cybersecurity Frameworks

We assist you in implementing cutting-edge cybersecurity frameworks that encompass best practices and industry standards, empowering your bank with the ability to proactively respond to threats and protect your valuable assets effectively.

Continuous Support

Our commitment to your bank's cybersecurity extends far beyond the initial implementation. We offer ongoing monitoring and support to ensure that your security measures remain resilient in the face of evolving threats and regulatory changes.

Deliverables

PCI DSS Compliance Gap Analysis

Risk Assessment and Risk Treatment Plan

PCI DSS Policies and Procedures

Encryption and Key Management Documentation

Security Incident Response Plan

Internal and External Compliance Reports

Service Provider Management Documentation

Cardholder Data Retention Policies

Attestation of Compliance

Our Promise

Strong Domain Expertise

We have in-depth knowledge and expertise in the cybersecurity domain, and we have the experience to provide your organization with comprehensive cybersecurity solutions.

Research-Oriented

Our team has a hands-on, research based approach when it comes to detecting cybersecurity attacks or providing solutions.

Renowned Industry Professionals

We have the best in class industry professionals, and we have served big corporate giants like Google, Facebook, and Yahoo by detecting loopholes and vulnerabilities in their cybersecurity systems.

Trusted by top brands

Frequently Asked Questions

PCI DSS stands for Payment Card Industry Data Security Standard. Compliance with PCI DSS is crucial for organizations that handle payment card information to protect against data breaches and payment card fraud. Compliance helps build customer trust, avoid financial penalties, and maintain a secure payment environment.

PCI DSS compliance can be validated through various methods, including self-assessment questionnaires (SAQs) for smaller organizations and on-site assessments by qualified security assessors (QSAs) for larger organizations. Compliance is validated annually or as required by the payment card brands.

Compliance with other security standards, such as ISO 27001 or NIST Cybersecurity Framework, can provide a foundation for PCI DSS compliance. However, PCI DSS has specific requirements tailored to the protection of payment card data, and organizations must address these requirements separately.

The timeline to achieve PCI DSS compliance varies depending on the size and complexity of your organization, existing security controls, and readiness. It typically involves a series of steps, including gap analysis, remediation, implementation of security controls, and validation, taking several months to a year.

PCI DSS compliance validation is typically required annually. However, certain organizations may be subject to more frequent assessments based on their transaction volume or specific agreements with payment card brands.

To request assistance for PCI DSS compliance, please contact our team using the provided contact information on our website. We will be pleased to discuss your specific requirements, provide guidance on the compliance process, and tailor our services to support your organization in achieving and maintaining PCI DSS compliance.